Công Ty Cổ Phần Thương Mại 125

Công Ty Cổ Phần Thương Mại 125 tiền thân là Xí Nghiệp Vật Liệu Xây Dựng 125 – đơn vị có trên 30 năm (1991 – nay) trong lĩnh vực vật liệu xây dựng và trang trí nội thất. Đặc biệt nổi trội trong kinh doanh sắt thép, thạch cao, các sản phẩm thép theo tiêu chuẩn: JIS, ASTM, BS, GOST, GB…

Với những nỗ lực trong công cuộc phát triển, hiện nay chúng tôi có 8 cơ sở trải rộng khắp tỉnh BRVT, chuyên kinh doanh các mặt hàng như: sắt, thép, nhôm kính, inox, điện dân dụng và trang trí, thiết bị cơ khí, vật tư ngành dầu khí, ngành hàng xây dựng, thiết bị, phụ kiện nội thất nhập khẩu Châu Âu, vật tư trang trí nội thất , đồng thời nhận thầu gia công, lắp đặt cửa nhôm, vách ngăn, cầu thang, trần thạch cao… với chất lượng và giá cả cạnh tranh nhất.

Dự án tiêu biểu

– Những dự án tiêu biểu mà VLXD125 đã thực hiện

Tin tức

– Những tin tức mới nhất

Thông báo nghỉ tết nguyên đán 2022

THÔNG BÁO LỊCH NGHỈ TẾT NGUYÊN ĐÁN 2022 VLXD 125 gửi để quý khách hàng lịch nghỉ Tết nguyên đán năm Nhâm Dần 2022. Thời gian nghỉ: từ 30/1/2022 đến hết 7/2/2022. Thời gian đi

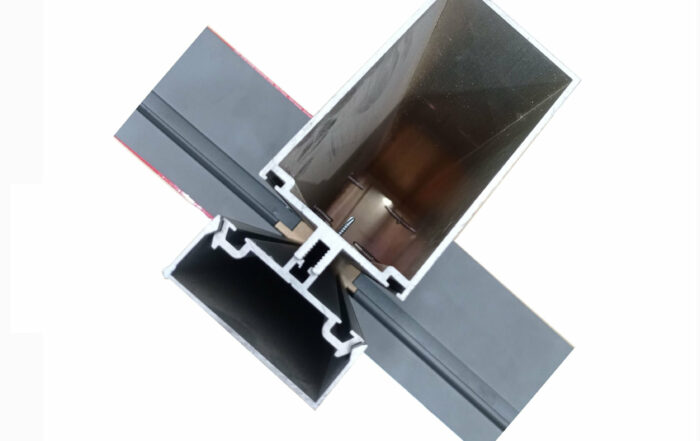

MẶT DỰNG ALUMEN XINGFA HỆ 65

MẶT DỰNG ALUMEN XINGFA HỆ 65 Vách mặt dựng nhôm 𝗔𝗟𝗨𝗠𝗘𝗡 Xingfa được xem là một trong những giải pháp hàng đầu cho các công trình hiện nay bởi nó có thể đáp ứng được

13 mẫu phòng bếp với thiết kế khiến bất kỳ ai cũng ghen tỵ và ao ước

Không chỉ tinh tế về kết cấu, kiểu dáng hay màu sắc, những phòng bếp này còn khiến người ta ước muốn bởi những dụng cụ hiện đại bậc nhất. Với nhiều người, bếp chính

Khách hàng - Đối tác

– Chất lượng dịch vụ là uy tín của VLXD125

Công Ty Cổ Phần Thương Mại 125 luôn nỗ lực không ngừng với mong muốn cung cấp chất lượng dịch vụ hoàn hảo nhất đến cho Quý khách hàng và đối tác. Nhờ đó, công ty đã từng bước xây dựng được niềm tin và ngày càng được nhiều Quý khách hàng, đối tác trong và ngoài nước quan tâm, hợp tác chia sẻ cơ hội kinh doanh. Chúng tôi trân trọng cảm ơn sự hợp tác quý báu của đối tác và khách hàng đã và đang đồng hành cùng chúng tôi đi đến thành công.